Vi vill gå helhjärtat in i våra satsningar. Vi bidrar inte bara med kapital utan genom aktivt styrelsearbete och bollplank till ledningen med vår erfarenhet, kunskap och kontaktnätverk.

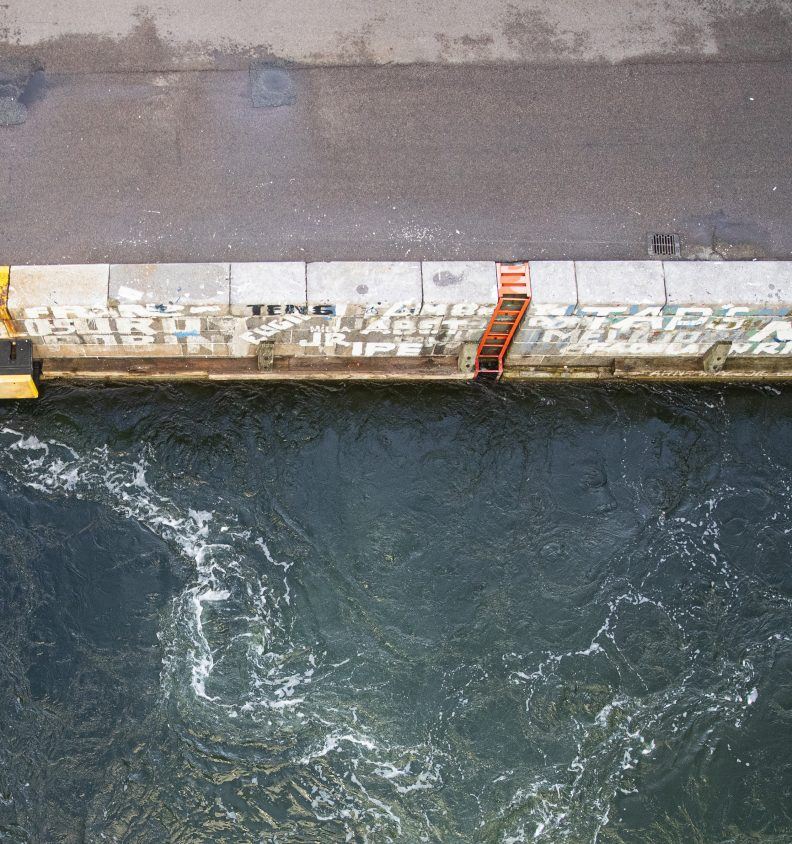

Nyfikenhet, glädje och viljan att utveckla bolag är många gånger lika viktigt för oss som resultat och avkastning. Nischade och specialiserade verksamheter tycker vi är intressanta. Vi vill gärna engagera oss i verksamheter som är en del av att lösa globala hållbarhetsutmaningar.

Vår egen största styrka finns kring industriella B2B-företag. Vi investerar främst i mogna bolag, men tittar även på innovativa tillväxtföretag med en färdig produkt eller tjänst som står inför en expansionsfas. Vi vill gärna att bolagen har en global potential och vision.

Våra investeringar är i huvudsak långsiktiga med ett djupt engagemang, men vi kan också vara involverade i företag eller projekt på kortare sikt där vi har mer eller mindre aktiva roller.